What Does Comdata Payment Solutions Do?

Wiki Article

First Data Merchant Services for Dummies

Table of ContentsEverything about Fintwist SolutionsThe Basic Principles Of Fintwist Solutions More About Payment SolutionsThe 20-Second Trick For Payeezy GatewayThe Ultimate Guide To Credit Card Processing CompaniesUnknown Facts About Comdata Payment SolutionsCredit Card Processing Can Be Fun For EveryoneSome Known Details About Square Credit Card Processing The smart Trick of Credit Card Processing Companies That Nobody is Discussing

One of the most common grievance for a chargeback is that the cardholder can not keep in mind the transaction. The chargeback ratio is very low for transactions in an in person (POS) setting. See Chargeback Management.You don't require to end up being a professional, however you'll be a much better consumer if you understand exactly how credit rating card handling really works. Who are the actors in a credit scores and also debit card transactions?

Little Known Facts About Square Credit Card Processing.

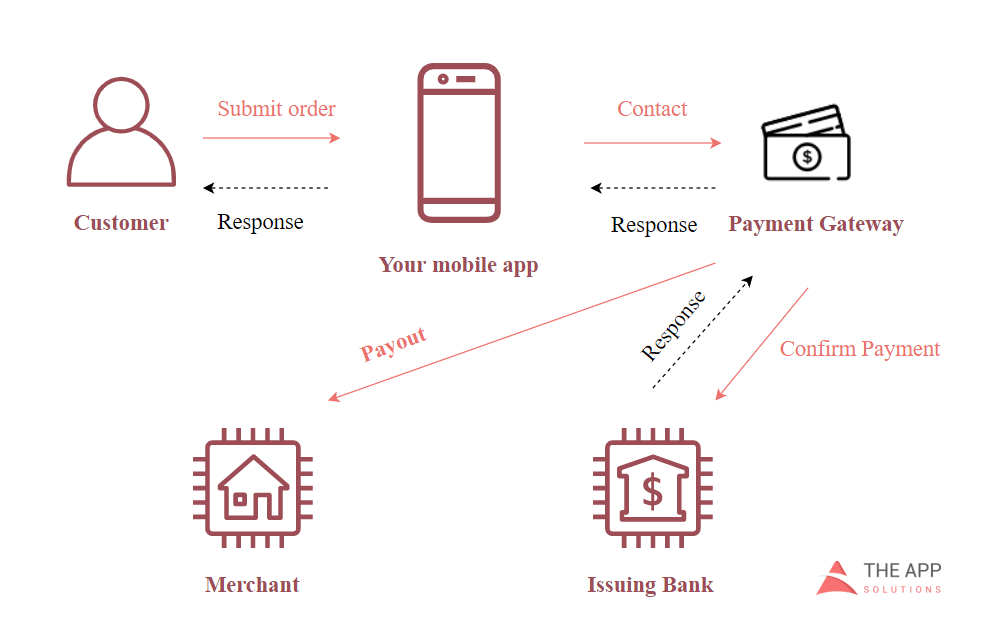

That's the charge card procedure essentially. Now let's take a look at. send batches of certified deals to their. The passes deal information to the that communicate the appropriate debits with the in their network. The fees the make up the quantity of the purchases. The after that transfers ideal funds for the purchases to the, minus interchange costs.

Some Known Facts About Payeezy Gateway.

You can obtain a merchant account using a settlement handling business, an independent professional, or a big bank. A repayment handling company or financial institution handles the purchases between your consumers' banks and your financial institution.You should allow sellers to gain access to info from the backend so they can view background of repayments, terminations, and also various other purchase data. PCI Safety and security aids vendors, sellers, as well as financial organizations apply requirements for developing protected settlement services.

More About Credit Card Processing Companies

Pay, Pal, for circumstances, is not subject to banking laws, so it can freeze your account and consequently your cash at will (payeezy gateway). Other disadvantages include high prices for some kinds of payment handling, restrictions on the number of purchases each day as well as quantity per deal, and safety openings. There's additionally a variety of on-line repayment processing software program (i.

The Best Guide To Online Payment Solutions

vendor accounts, often with a repayment gateway). These platforms differ in their payments as well as assimilation opportunities some software program is much better for audit while some fits fleet monitoring best. Another option is an open source payment processing system. Yet do not consider this as totally free processing. An open informative post source platform still needs to be PCI-compliant (which sets you back around $20k each year); you'll need to release it and also maintain numerous nodes; as well as you'll require to set up a partnership with an acquiring financial institution or a settlement processor.More About Virtual Terminal

They can additionally make your money flow more foreseeable, which is something that every local business proprietor aims for. Locate out even more how about B2B settlements work, and which are the very best B2B repayment items for your tiny organization. B2B settlements are settlements made in between 2 vendors for products or services.

Unknown Facts About Payment Hub

Individuals involved: There are numerous individuals included with each B2B transaction, consisting of receivables, accounts payable, billing, as well as purchase groups. Payment hold-up: When you pay a pal or member of the family for something, it's typically appropriate on-site (e. g. at the restaurant if you're breaking a bill) or just a few hours after the occasion.Because of the complexity of B2B repayments, increasingly more companies are choosing trackable, digital payment alternatives. Fifty-one percent of organizations informative post still pay by check, decreasing from 81% in 2004. And also 44% of companies still get repayment by check, decreasing from 75% in 2004. There are five major means to send and also receive B2B payments: Checks This category includes typical paper checks and also electronic checks provided by a customer to a vendor.

The Basic Principles Of Clover Go

Wire transfers These are funds transfers in between banks that are routed through a monetary network like SWIFT. Wire transfers typically supply money within hours. Electronic financial institution transfers These are payments in between financial institutions that are transmitted via the Automated Cleaning Residence (ACH). This is just one of the most safe and trustworthy settlement systems, however bank transfers take a few days longer than wire transfers.Payment entrance A repayment portal is an online settlement platform that permits the purchaser to pay right here for items or solutions online during the check out process. Each alternative varies in convenience of use for the sender and also recipient, expense, as well as security. That stated, most businesses are moving far from paper checks and also moving towards electronic and also digital settlements.

Credit Card Processing for Dummies

Repayments software program as well as apps have records that give you a summary of your receivables and accounts payable. If there a few sellers that on a regular basis pay you late, you can either enforce more stringent due dates or stop functioning with them. B2B payment options likewise make it much easier for your customers to pay you, helping you get payment much faster.Report this wiki page